ACUMEN Capital Protection Portfolio Prospectus

FundLogic Alternatives p.l.c. (an umbrella fund with segregated liability between sub-funds)

A company incorporated with limited liability as an open-ended investment company with variable capital under the laws of Ireland with registered number 483770

This Prospectus is dated 21 July 2017

The Directors of FundLogic Alternatives plc whose names appear in this Prospectus accept responsibility for the information contained in this Prospectus. To the best of the knowledge and belief of the Directors (who have taken all reasonable care to ensure such is the case) the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of such information. This Prospectus should be read in conjunction with the Supplements dealing with the relevant Sub-Fund(s).

FundLogic Alternatives plc

The authorisation of FundLogic Alternatives plc (the “Fund”) by the Central Bank shall not constitute a warranty as to the performance of the Fund and the Central Bank shall not be liable for the performance or default of the Fund.

Where an initial and/or repurchase charge is provided for the difference at any one time between the issue and repurchase price of Shares in the relevant Sub-Fund means that the investment should be viewed as medium to long term.

The value of and income from Shares in the Fund may go up or down and you may not get back the amount you have invested in the Fund.

Information applicable to the Fund generally is contained in this Prospectus. Shares constituting each sub-fund offered by the Fund (each a “Sub-Fund”) are described in the Supplements to this Prospectus.

Before investing in the Fund, you should consider the risks involved in such investment. Please see Risk Factors below and where applicable to each Sub-Fund in the Supplements.

If you are in any doubt about the contents of this Prospectus you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser.

Distribution of this Prospectus is not authorised in any jurisdiction unless accompanied by a copy of the then latest annual report and audited accounts of the Fund and, if published after such report, a copy of the then latest semi-annual report and unaudited accounts. Such reports and this Prospectus together form the prospectus for the issue of Shares in the Fund.

The Fund is an umbrella investment company with variable capital and segregated liability between Sub-Funds incorporated on 28 April 2010 and is authorised in Ireland as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (S.I. No. 352 of 2011) as amended. Such authorisation is not an endorsement or guarantee of the Fund or any Sub-Fund by the Central Bank, nor is the Central Bank responsible for the contents of this Prospectus.

This Prospectus may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. In particular: the Shares have not been registered under the United States Securities Act of 1933 (as amended) (the 1933 Act) and may not be directly or indirectly offered or sold in the United States or to any United States Person, except in a transaction which does not violate United States securities laws. The Fund will not be registered under the United States Investment Company Act of 1940 (as amended) (the 1940 Act).

The Articles of the Fund give powers to the Directors to impose restrictions on the holding of Shares by (and consequently to redeem Shares held by), or the transfer of Shares to, any person (including any United States Person) who appears to be in breach of the laws or requirements of any country or government authority or by any person or persons in circumstances (whether directly or indirectly affecting such person or persons, and whether taken alone or in conjunction with any other persons, connected or not, or any other circumstances appearing to the Directors to be relevant) which, in the opinion of the Directors, might result in the Fund incurring any liability to taxation or suffering any other pecuniary, regulatory, legal or material administrative disadvantage which the Fund might not otherwise have incurred or suffered. The Articles also permit the Directors where necessary to redeem and cancel Shares (including fractions thereof) held by a person who is, or is deemed to be, or is acting on behalf of, an Irish Taxable Person on the occurrence of a chargeable event for Irish taxation purposes.

Potential subscribers and purchasers of Shares should inform themselves as to (a) the possible tax consequences, (b) the legal requirements, (c) any foreign exchange restrictions or exchange control requirements and (d) any other requisite governmental or other consents or formalities which they might encounter under the laws of the countries of their incorporation, citizenship, residence or domicile and which might be relevant to the subscription, purchase, holding or disposal of Shares.

This Prospectus may be translated into other languages. Any such translation shall only contain the same information and have the same meanings as this English language document. Where there is any inconsistency between this English language document and the document in another language, this English language document shall prevail except to the extent (but only to the extent) required by the laws of any jurisdiction where the Shares are sold so that in an action based upon disclosure in a document of a language other than English, the language of the document on which such action is based shall prevail.

Any information given, or representations made, by any dealer, salesman or other person not contained in this Prospectus or in any reports and accounts of the Fund forming part hereof must be regarded as unauthorised and accordingly must not be relied upon. Neither the delivery of this Prospectus nor the offer, issue or sale of Shares shall under any circumstances constitute a representation that the information contained in this Prospectus is correct as of any time subsequent to the date of this Prospectus. To reflect material changes, this Prospectus may from time to time be updated and intending subscribers should enquire of the Administrator or the Distributor as to the issue of any later Prospectus or as to the issue of any reports and accounts of the Fund.

All Shareholders are entitled to the benefit of, are bound by and are deemed to have notice of, the provisions of the Articles, copies of which are available upon request.

Defined terms used in this Prospectus shall have the meaning attributed to them in Appendix I.

This Prospectus does not constitute an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such an offer or solicitation. Investors should be aware that it is the responsibility of any person wishing to make an application for Shares to inform themselves of, and comply with, all applicable laws and regulatory requirements.

An initial charge on the subscription of Shares and/or a repurchase charge on the redemption of Shares and/or an exchange charge on the exchange of Shares may be payable. Details of any such charges payable in respect of Shares of any Sub-Fund of the Fund, will be set out in the Supplement which relates to that Sub-Fund, but in any case will not exceed 5% in the case of a subscription charge and 3% in the case of a repurchase charge.

DIRECTORY

FundLogic Alternatives p.l.c. 70 Sir John Rogerson’s Quay Dublin 2 Ireland

INVESTMENT MANAGER As disclosed in the relevant Supplement

PROMOTER AND DISTRIBUTOR Morgan Stanley & Co. International plc 25 Cabot Square Canary Wharf London E14 4QA United Kingdom

DEPOSITARY Northern Trust Fiduciary Services (Ireland) Limited George’s Court 54-62 Townsend Street Dublin 2 Ireland

ADMINISTRATOR Northern Trust International Fund Administration Services (Ireland) Limited George’s Court 54-62 Townsend Street Dublin 2 Ireland

SECRETARY Matsack Trust Limited 70 Sir John Rogerson’s Quay Dublin 2 Ireland

AUDITORS Ernst & Young Harcourt Centre Harcourt Street Dublin 2 Ireland

IRISH LEGAL ADVISERS Matheson 70 Sir John Rogerson’s Quay Dublin 2 Ireland

1. INTRODUCTION

The Fund is structured as an umbrella investment company, in that different Sub-Funds may be established from time to time by the Directors with the prior approval of the Central Bank.

The particulars of each Sub-Fund will be set out in a separate supplement to the Prospectus (each a Supplement). Any such Supplement shall list all of the existing Sub-Funds. The Supplements should be read in conjunction with this Prospectus. Shares of more than one class may be issued in relation to a Sub-Fund. The creation of any new classes of Shares shall be notified to, and cleared, in advance by the Central Bank. On the introduction of any new class of Shares, the Fund will prepare and the Directors will issue documentation setting out the relevant details of each such class of Shares. A separate portfolio of assets shall be maintained for each Sub-Fund and shall be invested in accordance with the investment objective applicable to such Sub-Fund.

The Fund may decline any application for Shares in whole or in part without assigning any reason therefor and will not accept an initial subscription for Shares of any amount (exclusive of the initial charge, if any) which is less than the Minimum Initial Subscription as set forth in the Supplement for the relevant Sub-Fund, unless the Minimum Initial Subscription is waived by the Directors.

After the initial issue, Shares will be issued and redeemed at the Net Asset Value per Share plus or minus duties and charges (as the case may be) including any initial or repurchase charge specified in the relevant Supplements. The Net Asset Value of the Shares of each class and the issue and repurchase prices will be calculated in accordance with the provisions summarised under the heading Issue and Repurchase Prices/Calculation of Net Asset Value/Valuation of Assets in this Prospectus.

Details of Dealing Days in respect of each Sub-Fund are set out in the relevant Supplement.

All holders of Shares will be entitled to the benefit of, will be bound by and deemed to have notice of the provisions of the Articles summarised under the heading General Information in this Prospectus, copies of which are available as detailed in this Prospectus.

The Fund has segregated liability between its Sub-Funds and accordingly any liability incurred on behalf of or attributable to any Sub-Fund shall be discharged solely out of the assets of that Sub-Fund.

2. Directors of the Fund

The Directors of the Fund are described below:

Kevin Molony has broad and extensive experience in investment management, institutional stockbroking and management services having worked with leading international firms over his career. He currently provides independent directorship services to several international investment managers. Kevin was Managing Director of Walkers Corporate Services (Dublin) Limited until that business was acquired in June 2012. From 1999 to 2009, he was a Director of Citigroup Global Markets where he was instrumental in establishing and building their Irish institutional broking business. His specific area of expertise at Citigroup was US and Latin American equities. Before joining Citigroup, he was an institutional stockbroker with Deutsche Bank. Kevin began his career as a UK equity fund manager with Phillips & Drew Fund Managers, who were the leading institutional investment manager in London at the time. He later joined AIB Investment Managers as a Senior Portfolio Manager specialising in US equity funds. Kevin received a BA in Economics from University College Dublin and a Professional Diploma in Corporate Governance from Smurfit Business School, Dublin.

Simon O’Sullivan has worked in the investment management sector since 1993. From April 2002 to April 2006, he was employed in Dublin by Pioneer Alternative Investments as a product specialist. In May 2006, he left Pioneer to join his family company as financial controller and in May 2013 Simon became a partner in Maraging Funds Limited, trading as RiskSystem, a specialist provider of financial risk solutions to the investment funds industry. He has also worked for Fleming Investment Management as a fund manager in London, and Eagle Star and Merrion Capital, both in Dublin. He holds a Bachelor of Arts in Economics and Politics, a Master of Arts in Economics, a Master of Sciences in Investment & Treasury Management and a Diploma in Corporate Governance. Mr O’Sullivan is a non-executive director of a number of investment funds.

David Haydon is a Managing Director at Morgan Stanley and Head of Complex Structures, fund and fund-linked business within the DSP sub-division in Institutional Equities. David joined Morgan Stanley in 2003 and is a certified public accountant. Prior to his current role, he worked as chief operating officer and head of product control for the Delta 1 structured products business within Morgan Stanley.

The Fund has delegated the day to day management, administration and running of the Fund in accordance with policies approved by the Directors, to the Administrator, the Investment Manager and the Distributor and has appointed the Depositary as depositary of its assets. Consequently, all Directors of the Fund are non-executive.

3. Investment Manager

The Investment Manager of a number of Sub-Funds of the Fund is Fundlogic SAS which is incorporated in France. The Fund may appoint other investment managers in respect of a specific Sub-Fund. Alternatively, the Investment Manager may appoint one or more sub-investment managers in respect of a specific Sub-Fund. Details of other investment managers or sub-investment managers, if any, appointed to specific Sub-Funds will be set forth in the Supplement for the relevant Sub-Fund. Any such Supplement will be submitted to the Central Bank in advance of the appointment of any such other investment managers or sub-investment managers.

The Investment Manager has been appointed to provide investment management services to the Fund.

The Investment Manager’s registered office is at 61 Rue de Monceau, 75008 Paris, France.

Subject to controls imposed by the Directors under the investment management agreement, all relevant laws and regulations, this Prospectus and the Articles, the Investment Manager has discretion to take day-to-day investment decisions and to deal in investments and to conduct the investment management of the Fund.

The Investment Manager is regulated by the Autorite des Marches Financiers in France.

As at 30 April 2017, Fundlogic SAS had approximately US$4.4 billion of assets under management.

Under the investment management agreement, the Investment Manager may, subject to the prior approval of the Fund and the Central Bank, appoint one or more Sub-Investment Managers from time to time to perform and/or exercise all or any of its functions, powers, discretions, duties and obligations under the investment management agreement. Such Sub-Investment Managers will not be paid out of the assets of the Fund. Details of such SubInvestment Managers will be provided to Shareholders on request and details of any Sub-Investment Manager will be disclosed in the periodic reports of the Fund.

For the avoidance of doubt, all references in the remainder of this document to the Investment Manager shall include such other investment manager or sub-investment manager, as appropriate.

4. Depositary

The Fund has appointed Northern Trust Fiduciary Services (Ireland) Limited to act as depositary to the Fund.

The Depositary is a private limited liability company incorporated in Ireland on 5 July 1990. Its main activity is the provision of custodial services to collective investment schemes. The Depositary is an indirect wholly-owned subsidiary of Northern Trust Corporation. Northern Trust Corporation and its subsidiaries comprise the Northern Trust Group, one of the world’s leading providers of global custody and administration services to institutional and personal investors. As at 31 March 2017, the Northern Trust Group’s assets under custody totalled in excess of US$7.1 trillion.

The Depositary has been entrusted with the following main functions:

(i) ensuring that the sale, issue, repurchase, redemption and cancellation of Shares are carried out in accordance with applicable law and the Articles;

(ii) ensuring that the value of the Shares is calculated in accordance with applicable law and the Articles;

(iii) carrying out the instructions of the Fund unless they conflict with applicable law and the Articles;

(iv) ensuring that in transactions involving the assets of the Fund any consideration is remitted within the usual time limits;

(v) ensuring that the income of the Fund is applied in accordance with applicable law and the Articles;

(vi) monitoring the Fund’s cash and cash flows; and

(vii) safe-keeping of the Fund’s assets, including the safekeeping of financial instruments to be held in custody and ownership verification and record keeping in relation to other assets.

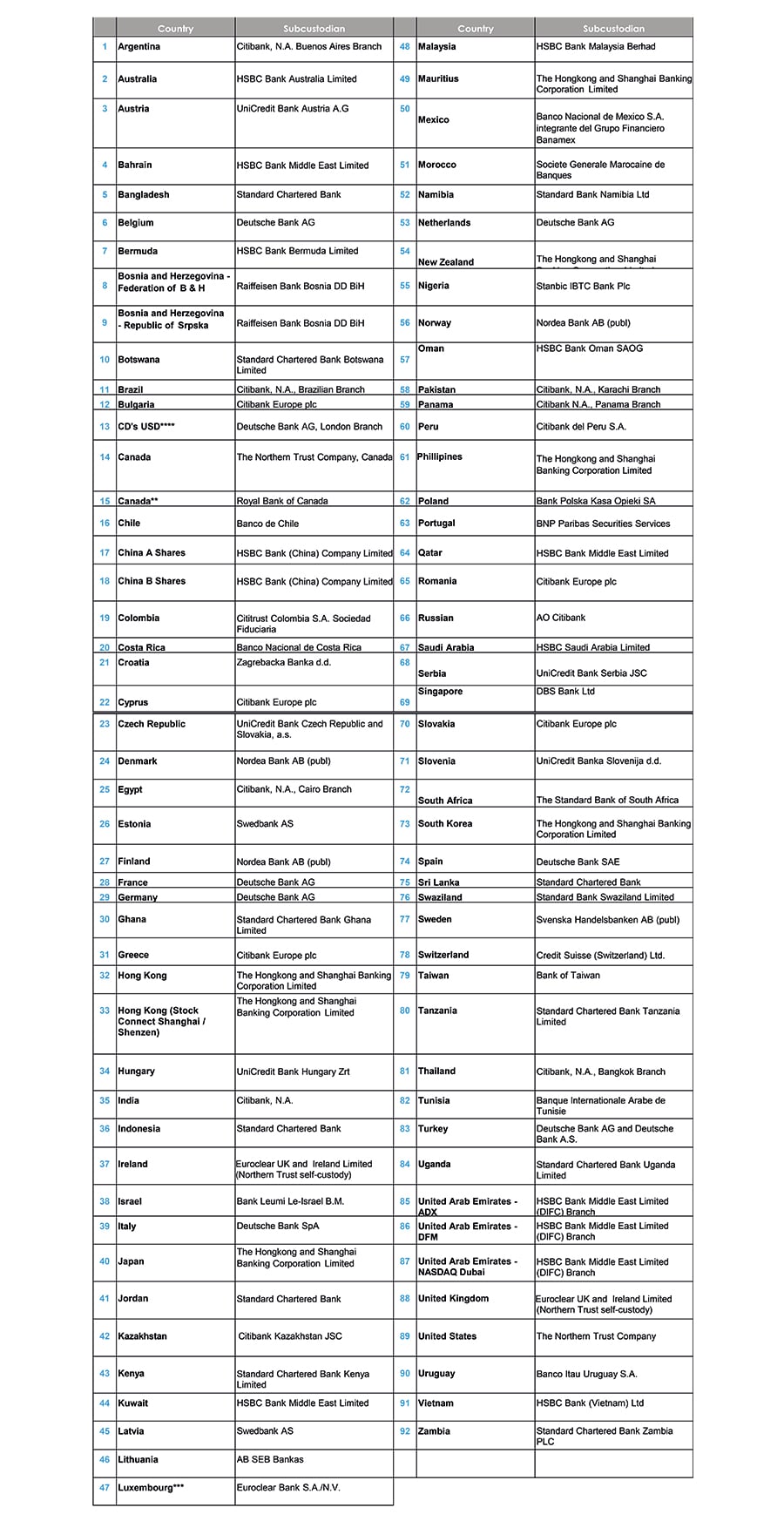

Up-to-date information on the Depositary, its duties, any conflicts that may arise, the safe-keeping functions delegated by the Depositary, the list of delegates and sub-delegates and any conflicts of interest that may arise from such a delegation will be made available to the Shareholders on request from the Fund. A list of the Depositary’s delegates is outlined in detail at Appendix III.

5. Administrator and Registrar

The Fund has appointed Northern Trust International Fund Administration Services (Ireland) Limited to act as administrator, registrar and transfer agent of each Sub-Fund.

The Administrator is responsible for the administration of the Fund’s affairs including the calculation of the Net Asset Value and preparation of the Fund’s annual and semi-annual report, subject to the overall supervision of the Fund. The Administrator is not responsible for the monitoring of the Fund’s or any Sub-Fund’s investments with any investment rules and restrictions contained in any agreement and / or this Prospectus, unless otherwise stated.

The Administrator was incorporated as a limited liability company on 15 June 1990. The Administrator is a wholly owned subsidiary of Northern Trust Corporation. Northern Trust Corporation and its subsidiaries comprise the Northern Trust Group, one of the world’s leading providers of global custody and administration services to institutional and personal investors. The Administrator’s principal business is the provision of administration services to collective investment schemes.

6. Investment Objective and Policies

The Articles provide that the investment objective and policies for each Sub-Fund will be formulated by the Directors at the time of the creation of the Sub-Fund. Details of the investment objective and policies of each SubFund appear in the Supplement for the relevant Sub-Fund. Any changes in the investment objective or any material change to the investment policy of a Sub-Fund may only be made with the approval of an ordinary resolution of the Shareholders of the relevant Sub-Fund. Subject and without prejudice to the preceding sentence in the event of a change of investment objective and/or a material change of investment policy of a Sub-Fund, a reasonable notification period must be given to each Shareholder of the relevant Sub-Fund to enable them to redeem their Shares.

7. Restrictions

The particular investment restrictions for each Sub-Fund will be formulated by the Directors at the time of the creation of the Sub-Fund and will appear in the Supplement for the relevant Sub-Fund.

Details of the investment restrictions laid down in accordance with the Central Bank UCITS Regulations in respect of each Sub-Fund are set out below.

8. Borrowing and Lending Powers

The Fund may borrow up to 10% of a Sub-Fund’s net assets at any time for the account of the Sub-Fund and the Fund may charge the assets of such Sub-Fund as security for any such borrowing, provided that such borrowing is only for temporary purposes. Any particular borrowing restrictions for a Sub-Fund will appear in the Supplement for the relevant Sub-Fund. Without prejudice to the powers of the Fund to invest in transferable securities, the Fund may not lend to, or act as guarantor on behalf of, third parties. A Sub-Fund may acquire debt securities and securities which are not fully paid.

9. Permitted Investments

Investments of each Sub-Fund are confined to:

9.1. Transferable securities and money market instruments which are either admitted to official listing on a stock exchange in a Member State or non-Member State or which are dealt on a market which is regulated, operates regularly, recognised and open to the public in a Member State or non-Member State (and which in each case is listed in Appendix II).

9.2. Recently issued transferable securities which will be admitted to official listing on a stock exchange or other market (as described above) within a year.

9.3. Money market instruments other than those dealt on a regulated market.

9.4. Units of UCITS.

9.5. Units of alternative investment funds (AIFs).

9.6. Deposits with credit institutions.

9.7. Financial derivative instruments (FDI).

10. Investment Restrictions

10.1. Each Sub-Fund may invest no more than 10% of net assets in transferable securities and money market instruments other than those referred to in paragraph 10.1.

10.2. Each Sub-Fund may invest no more than 10% of net assets in recently issued transferable securities which will be admitted to official listing on a stock exchange or other market (as described in paragraph 10.1 within a year. This restriction will not apply in relation to investment by each Sub-Fund in certain US securities known as Rule 144A securities provided that:

10.2.1. the securities are issued with an undertaking to register with the US Securities and Exchanges Commission within one year of issue; and

10.2.2. the securities are not illiquid securities i.e. they may be realised by each Sub-Fund within seven days at the price, or approximately at the price, at which they are valued by the Sub-Fund.

10.3. Each Sub-Fund may invest no more than 10% of net assets in transferable securities or money market instruments issued by the same body provided that the total value of transferable securities and money market instruments held in the issuing bodies in each of which it invests more than 5% is less than 40%.

10.4. Subject to the prior approval of the Central Bank, the limit of 10% in 11.3 is raised to 25% in the case of bonds that are issued by a credit institution which has its registered office in a Member State and is subject by law to special public supervision designed to protect bond-holders. If a Sub-Fund invests more than 5% of its net assets in these bonds issued by one issuer, the total value of these investments may not exceed 80% of the net asset value of the Sub-Fund.

10.5. The limit of 10% in 11.3 is raised to 35% if the transferable securities or money market instruments are issued or guaranteed by a Member State or its local authorities or by a non-Member State or public international body of which one or more Member States are members.

10.6. The transferable securities and money market instruments referred to in 11.4 and 11.5 shall not be taken into account for the purpose of applying the limit of 40% referred to in 11.3.

10.7. Deposits with any one credit institution, other than credit institutions authorised in the EEA or credit institutions authorised within a signatory state (other than an EEA Member State) to the Basle Capital Convergence Agreement of July 1988, or a credit institution authorised in Jersey, Guernsey, the Isle of Man, Australia or New Zealand held as ancillary liquidity, must not exceed 10% of net assets.

This limit may be raised to 20% in the case of deposits made with the Depositary.

10.8. The risk exposure of each Sub-Fund to a counterparty in an over the counter (OTC) derivative transaction may not exceed 5% of net assets.

This limit is raised to 10% in the case of credit institutions authorised in the EEA or credit institutions authorised within a signatory state (other than an EEA Member State) to the Basle Capital Convergence Agreement of July 1988; or a credit institution authorised in Jersey, Guernsey, the Isle of Man, Australia or New Zealand.

10.9. Notwithstanding paragraphs 11.3, 11.7 and 11.8 above, a combination of two or more of the following issued by, or made or undertaken with, the same body may not exceed 20% of net assets:

10.9.1. investments in transferable securities or money market instruments;

10.9.2. deposits, and/or

10.9.3. counter party risk exposures arising from OTC derivative transactions.

10.10. The limits referred to in 11.3, 11.4, 11.5, 11.7, 11.8 and 11.9 above may not be combined, so that exposure to a single body shall not exceed 35% of net assets.

10.11. Group Companies are regarded as a single issuer for the purposes of 11.3, 11.4, 11.5, 11.7, 11.8 and 11.9. However, a limit of 20% of net assets may be applied to investment in transferable securities and money market instruments within the same group.

10.12. Each Sub-Fund may invest up to 100% of net assets in transferable securities and money market instruments issued or guaranteed by OECD Governments (provided the relevant issues are investment grade), the Governments of Brazil or India (provided the relevant issues are investment grade), Government of Singapore, European Investment Bank, European Bank for Reconstruction and Development, International Finance Corporation, International Monetary Fund, Euratom, The Asian Development Bank, European Central Bank, Council of Europe, Eurofima, African Development Bank, International Bank for Reconstruction and Development (The World Bank), The Inter American Development Bank, European Union, Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Government National Mortgage Association (Ginnie Mae), Student Loan Marketing Association (Sallie Mae), Federal Home Loan Bank, Federal Farm Credit Bank, Tennessee Valley Authority, and Straight-A Funding LLC.

Each Sub-Fund must hold securities from at least 6 different issues, with securities from any one issue not exceeding 30% of net assets.

11. Investment in Collective Investment Schemes

11.1. A Sub-Fund may not invest more than 10% of net assets in other open-ended CIS.

11.2. When a Sub-Fund invests in the units of other CIS that are managed, directly or by delegation, by the Sub-Fund’s investment manager or by any other company with which the investment manager is linked by common management or control, or by a substantial direct or indirect holding, neither the investment manager nor that other company may charge initial, conversion or repurchase fees on account of that Sub-Fund’s investment in the units of such other CIS.

11.3. Where a commission (including a rebated commission) is received by a Sub-Fund’s investment manager by virtue of an investment in the units of another CIS, this commission must be paid into the property of the Sub-Fund.

Index Tracking Sub-Funds

11.4. A Sub-Fund may invest up to 20% of net assets in shares and/or debt securities issued by the same body where the investment policy of the Sub-Fund is to replicate an index which satisfies the criteria set out in the Central Bank UCITS Regulations and is recognised by the Central Bank.

11.5. The limit in 12.4 may be raised to 35%, and applied to a single issuer, where this is justified by exceptional market conditions.

12. General Provisions

12.1. The Investment Manager, acting in connection with all of the CIS it manages, may not acquire any shares carrying voting rights which would enable it to exercise significant influence over the management of an issuing body.

12.2. Each Sub-Fund may acquire no more than:

12.2.1. 10% of the non-voting shares of any single issuing body;

12.2.2. 10% of the debt securities of any single issuing body;

12.2.3. 25% of the units of any single CIS;

12.2.4. 10% of the money market instruments of any single issuing body.

NOTE: The limits laid down in 13.2.2, 13. 2.3 and 13.2.4 above may be disregarded at the time of acquisition if at that time the gross amount of the debt securities or of the money market instruments, or the net amount of the securities in issue cannot be calculated.

12.3. 13.1 and 13.2 shall not be applicable to:

12.3.1. transferable securities and money market instruments issued or guaranteed by a Member State or its local authorities;

12.3.2. transferable securities and money market instruments issued or guaranteed by a non-Member State;

12.3.3. transferable securities and money market instruments issued by public international bodies of which one or more Member States are members;

12.3.4. shares held by each Sub-Fund in the capital of a company incorporated in a non-member State which invests its assets mainly in the securities of issuing bodies having their registered offices in that State, where under the legislation of that State such a holding represents the only way in which each Sub-Fund can invest in the securities of issuing bodies of that State. This waiver is applicable only if in its investment policies the company from the non-Member State complies with the limits laid down in 11.3 to 11.11, 13.1, 13.2, 13.4, 13.5 and 13.6 and provided that where these limits are exceeded, 13.5 and 13.6 are observed;

12.3.5. shares held by the Sub-Fund in the capital of subsidiary companies carrying on only the business of management, advice or marketing in the country where the subsidiary is located, in regard to the repurchase of shares at Shareholders’ request exclusively on their behalf.

12.4. A Sub-Fund need not comply with the investment restrictions herein when exercising subscription rights attaching to transferable securities or money market instruments which form part of their assets.

12.5. the Central Bank may allow recently authorised Sub-Funds to derogate from the provisions of 11.3 to 11.12,12.4 and 12.5 for six months following the date of their authorisation, provided they observe the principle of risk spreading.

12.6. If the limits laid down herein are exceeded for reasons beyond the control of a Sub-Fund, or as a result of the exercise of subscription rights, the Sub-Fund must adopt as a priority objective for its sales transactions the remedying of that situation, taking due account of the interests of its shareholders.

12.7. A Sub-Fund may not carry out uncovered sales of:

12.7.1. transferable securities;

12.7.2. money market instruments;

12.7.3. units of CIS; or

12.7.4. FDIs

12.8. A Sub-Fund may hold ancillary liquid assets.

12.9. It is intended that each Sub-Fund should have the power to avail of any change in the law, regulations or guidelines which would permit investment in assets and securities on a wider basis in accordance with the requirements of the Central Bank.

13. Financial Derivative Instruments

13.1. A Sub-Fund’s global exposure relating to FDI must not exceed its total net asset value.

13.2. Position exposure to the underlying assets of FDI, including embedded FDI in transferable securities or money market instruments, when combined where relevant with positions resulting from direct investments, may not exceed the investment limits set out in the Central Bank UCITS Regulations (This provision does not apply in the case of index based FDI provided the underlying index is one which meets with the criteria set out in the Central Bank UCITS Regulations.)

13.3. A Sub-Fund may invest in FDIs dealt in over the counter (OTC) provided that the counterparties to over-thecounter transactions are institutions, with legal personality, typically located in OECD jurisdictions, subject to prudential supervision and belonging to categories approved by the Central Bank.

13.4. Investments in FDIs are subject to the conditions and limits laid down by the Central Bank.

The Fund employs a risk management process in respect of each Sub-Fund which enables it to accurately measure, monitor and manage the various risks associated with FDI. A statement of this risk management process has been submitted to the Central Bank. The Fund will, on request, provide supplementary information to Shareholders relating to any risk management methods to be employed by the Fund in respect of any Sub-Fund, including the quantitative limits that are applied, and any recent developments in the risk and yield characteristics of the main categories of investments. Any FDI contemplated by this Prospectus but which are not included in the risk management process will not be utilised until such time as a revised risk management process has been provided to the Central Bank. The techniques and instruments to be used for each Sub-Fund, if any, will be set forth in the relevant Supplement.

14. Efficient Portfolio Management

The Fund may employ, without limit, investment techniques and instruments for efficient portfolio management of the assets of the Fund or of any Sub-Fund and for short term investment purposes under the conditions stipulated by the Central Bank under the Regulations and described below. Use of techniques and instruments which relate to transferable securities and money market instruments and which are used for the purposes of efficient portfolio management shall be understood as a reference to techniques and instruments which fulfil the following criteria:

14.1. They are economically appropriate in that they are realised in a cost effective way;

14.2. They are entered into for one or more of the following specific aims:

14.2.1. the reduction of risk;

14.2.2. the reduction of cost; or

14.2.3. the generation of additional capital or income for the Sub-Fund for a level of risk which is consistent with the risk profile of the Sub-Fund and the risk diversification rules set out in the Central Bank UCITS Regulations.

14.3. Their risks are adequately captured in the risk management process; and

14.4. They cannot result in a change to the Sub-Fund’s declared investment objective or add substantial supplementary risks in comparison to the general risk policy as described in its sales documents.

FDI used for efficient portfolio management must also comply with the Central Bank UCITS Regulations. Such FDI may comprise futures, forwards, options and swaps and their use may include hedging against market movements, currency exchange or interest rate risks in accordance with the investment policies of a Sub-Fund and under the conditions and within the limits stipulated by the Central Bank under the Regulations.

In respect of Hedged Share Classes it is expected that the extent to which the relevant currency exposure will be hedged will, subject to the requirements and conditions of the Central Bank, range from 95% to 105% of the Net Asset Value of the relevant Hedged Share Class. Over-hedged or under-hedged positions may arise due to factors outside the control of the relevant Sub-Fund. Hedged positions will be kept under review to ensure that over-hedged positions do not exceed 105% of the Net Asset Value of the relevant Hedged Share Class. This review will incorporate a procedure to ensure that positions materially in excess of 100% will not be carried forward from month to month.

14.5 A Sub-Fund may also enter into repurchase/reverse repurchase (“repo contracts”) and/or stock lending agreements in accordance with the requirements of the Central Bank. Repo contracts and securities lending transactions do not constitute borrowing for the purposes of the Regulations. The following applies to repo contracts and securities lending arrangements entered into in respect of Fund and reflects the requirements of the Central Bank and is subject to changes thereto:

(a) Repo contracts and securities lending may only be effected in accordance with normal market practice.

(b) The Fund must have the right to terminate any securities lending arrangement which it has entered into at any time or demand the return of any or all of the securities loaned.

(c) Where the Fund enters into repurchase agreements in respect of a Sub-Fund, the Fund must be able at any time to recall any securities subject to the repurchase agreement or to terminate the repurchase agreement into which it has entered. Fixed-term repurchase agreements that do not exceed seven days should be considered as arrangements on terms that allow the assets to be recalled at any time by the Fund.

(d) Where the Fund enters into reverse repurchase agreements in respect of a Sub-Fund, the Fund must be able at any time to recall the full amount of cash or to terminate the reverse repurchase agreement on either an accrued basis or a mark-to-market basis. When the cash is recallable at any time on a mark-tomarket basis, the mark-to-market value of the reverse repurchase agreement should be used for the calculation of the Net Asset Value. Fixed-term reverse repurchase agreements that do not exceed seven days should be considered as arrangements on terms that allow the assets to be recalled at any time by the Fund.

The counterparty to a repo contract or securities lending arrangement must satisfy the relevant requirements of the Central Bank UCITS Regulations. Where the counterparty is subject to a credit rating by any agency registered and supervised by the European Securities and Markets Authority, that rating shall be taken into account in the credit assessment. Where a counterparty is downgraded to A2 or below (or comparable rating) by such a credit rating agency, a new credit assessment in respect of the counterparty will be undertaken without delay.

Any revenues from efficient portfolio management techniques not received directly by the Fund in respect of a Sub-Fund, net of direct and indirect operational costs and fees (which do not include hidden revenue), will be returned to the Sub-Fund. The entities to which any direct and indirect costs and fees are paid will be disclosed in the periodic reports of the Fund and will indicate if these are parties related to the Fund or the Depositary. To the extent that the Fund engages in securities lending in respect of the Sub-Fund it may appoint a securities lending agent which may receive a fee in relation to its securities lending activities. Any such securities lending agent is not expected to be an affiliate of the Depositary or Investment Manager. Any operational costs arising from such securities lending activities shall be borne by the securities lending agent out of its fee.

Each Sub-Fund’s exposure to securities financing transactions (total return swaps, repo contracts and securities lending arrangements) will be outlined in detail in the relevant Supplement.

14.6 Management of collateral for OTC FDI transactions and efficient portfolio management

For the purposes of this section, “Relevant Institutions” refers to those institutions which are credit institutions authorised in the EEA or credit institutions authorised within a signatory state (other than an EEA Member State) to the Basle Capital Convergence Agreement of July 1988 or credit institutions authorised in Jersey, Guernsey, the Isle of Man, Australia or New Zealand.

(a) Collateral obtained in respect of OTC FDI transactions and efficient portfolio management techniques (“Collateral”), such as a repo contract or securities lending arrangement, must comply with the following criteria:

(i) liquidity: Collateral (other than cash) should be transferable securities or money market instruments (of any maturity) which must be highly liquid and traded on a regulated market or multi-lateral trading facility with transparent pricing in order that it can be sold quickly at a price that is close to its pre-sale valuation. Collateral received should also comply with the provisions of Regulation 74 of the Regulations;

(ii) valuation: Collateral should be capable of being valued on a daily basis and assets that exhibit high price volatility should not be accepted as Collateral unless suitably conservative haircuts are in place. Collateral may be marked to market daily by the counterparty using its procedures, subject to any agreed haircuts, reflecting market values and liquidity risk and may be subject to variation margin requirements;

(iii) issuer credit quality: Collateral should be of high quality;

(iv) correlation: Collateral should be issued by an entity that is independent from the counterparty and is expected not to display a high correlation with the performance of the counterparty;

(v) diversification: Collateral should be sufficiently diversified in terms of country, markets and issuers with a maximum exposure to a given issuer of 20% of the Sub-Fund’s Net Asset Value. When the Sub-Fund is exposed to different counterparties the different baskets of collateral should be aggregated to calculate the 20% limit of exposure to a single issuer.

By way of derogation from this sub-paragraph, a Sub-Fund may be fully collateralised in any of the issuers listed in paragraph 10.12. Such a Sub-Fund will receive securities from at least six different issues and securities from any single issue will not account for more than 30% of the Sub-Fund’s Net Asset Value; and

(vi) immediately available: Collateral must be capable of being fully enforced by the Fund at any time without reference to or approval from the counterparty.

All assets received in respect of a Sub-Fund in the context of efficient portfolio management techniques will be considered as Collateral for the purposes of the Regulations and will comply with the criteria above. Risks linked to the management of collateral, including operational and legal risks, are identified and mitigated by risk management procedures employed by the Fund.

(b) Collateral must be held by the Depositary or its agent (where there is title transfer). This is not applicable in the event that there is no title transfer in which case the Collateral can be held by a third party Depositary which is subject to prudential supervision, and which is unrelated to the provider of the Collateral.

(c) Non-cash Collateral cannot be sold, re-invested or pledged.

(d) Cash Collateral:

Cash received as Collateral may only be:

(i) placed on deposit, or invested in certificates of deposit, with Relevant Institutions;

(ii) invested in high quality government bonds;

(iii) used for the purpose of reverse repurchase agreements provided the transactions are with credit institutions subject to prudential supervision and the Fund can recall at any time the full amount of the cash on an accrued basis; and

(iv) invested in short term money market funds.

Re-invested cash collateral should be diversified in accordance with the diversification requirements applicable to non-cash Collateral set out above. The Fund must be satisfied, at all times, that any investment of cash Collateral will enable it to meet with its repayment obligations. Invested cash Collateral may not be placed on deposit with, or investment in securities issued by, the counterparty of related entity.

(e) The Fund has implemented a documented haircut policy in respect of each class of assets received as Collateral in respect of a Sub-Fund. A haircut is a discount applied to the value of a Collateral asset to account for the fact that its valuation, or liquidity profile, may deteriorate over time. The haircut policy takes account of the characteristics of the relevant asset class, including the credit standing of the issuer of the Collateral, the price volatility of the Collateral and the results of any stress tests which may be performed in accordance with the stress testing policy. The value of any Collateral received by the Fund, adjusted in light of the haircut policy, shall equal or exceed, in value, at all times, the relevant counterparty exposure.

(f) The risk exposures to a counterparty arising from OTC FDI transactions and efficient portfolio management techniques should be combined when calculating the counterparty risk limits set out in the section of the Prospectus entitled Investment Restrictions.

(g) In the event that a Sub-Fund received Collateral for at least 30% of its net assets, it will implement a stress testing policy to ensure that regular stress tests carried out under normal and exceptional liquidity conditions in order to allow it to assess the liquidity risk attached to Collateral.

15. Risk Factors

The following risk factors may apply in respect of any investment in the Fund:

15.1. General

The investments of the Fund in securities are subject to normal market fluctuations and other risks inherent in investing in securities. The value of investments and the income from them, and therefore the value of, and income from, Shares relating to each Sub-Fund can go down as well as up and an investor may not get back the amount he invests. Changes in exchange rates between currencies or the conversion from one currency to another may also cause the value of investments to diminish or increase.

While the provisions of the Companies Act provide for segregated liability between Sub-Funds, these provisions have yet to be tested in foreign courts, in particular, in satisfying local creditors’ claims. Accordingly, it is not free from doubt that the assets of any Sub-Fund of the Fund may not be exposed to the liabilities of other Sub-Funds of the Fund. As at the date of this Prospectus, the Directors are not aware of any existing or contingent liability of any Sub-Fund of the Fund.

The Fund and the Investment Manager will not have control over the activities of any company or collective investment scheme invested in by a Sub-Fund. Managers of collective investment schemes and companies in which a Sub-Fund may invest may take undesirable tax positions, employ excessive leverage, or otherwise manage the collective investment schemes or be managed in a manner not anticipated by the Investment Manager.

There is no assurance that each Sub-Fund will achieve its investment objective.

15.2. Withholding tax

The income and gains of the Fund from its assets may suffer withholding tax which may not be reclaimable in the countries where such income and gains arise. If this position changes in the future and the application of a lower rate results in a repayment to the Fund, the relevant Net Asset Value will not be re-stated and the benefit will be allocated to the existing Shareholders rateably at the time of repayment.

15.3. FATCA

The Fund will require Shareholders to certify information relating to their status for FATCA purposes and to provide other forms, documentation and information in relation to their FATCA status. The Fund may be unable to comply with its FATCA obligations if Shareholders do not provide the required certifications or information. In such circumstances, the Fund could become subject to US FATCA withholding tax in respect of its US source income if the US Internal Revenue Service specifically identified the Fund as being a ‘non-participating financial institution’ for FATCA purposes. Any such US FATCA withholding tax would negatively impact the financial performance of the Fund and all Shareholders may be adversely affected in such circumstances. Your attention is drawn to the section “U.S. Foreign Account Tax Compliance Act” under “Taxation” below.

15.4. Foreign Taxes

The Fund may be liable to taxes (including withholding taxes) in countries other than Ireland on income earned and capital gains arising on its investments. The Fund may not be able to benefit from a reduction in the rate of such foreign tax by virtue of the double taxation treaties between Ireland and other countries. The Fund may not, therefore, be able to reclaim any foreign withholding tax suffered by it in particular countries. If this position changes and the Fund obtains a repayment of foreign tax, the Net Asset Value of the Fund will not be restated and the benefit will be allocated to the then-existing Shareholders rateably at the time of repayment.

15.5. Repurchase, Reverse Repurchase and stock lending transactions

A Sub-Fund may enter into repurchase, reverse repurchase and stock agreements subject to the conditions and limits set out in the Central Bank UCITS Regulations. If the other party to an agreement should default, the SubFund might suffer a loss to the extent that the proceeds from the sale of the underlying securities or Collateral as the case may be held by the Sub-Fund in connection with the refuted repurchase agreement are less than the repurchase price. In addition, in the event of bankruptcy or similar proceedings of the other party to the repurchase agreement or its failure to repurchase or return the securities as agreed, the Sub-Fund could suffer losses, including loss of interest on or principal of the security and costs associated with delay and enforcement of the repurchase agreement.

15.6. Currency risks

In circumstances where a Sub-Fund employs hedging techniques in respect of non-Base Currency denominated investments in order to seek to hedge the currency exchange risk back to the Base Currency, a risk remains that such hedging techniques may not always achieve the objective of seeking to limit losses and exchange rate risks. Performance may be strongly influenced by movements in currency exchange rates because currency positions held by the Sub-Fund may not correspond with the securities positions held. In the case of Unhedged Share Classes the value of the Share expressed in the Class currency will be subject to exchange rate rise in relation to Base Currency.

15.7. Hedged Share Classes

Hedged Share Classes utilise hedging strategies to seek to limit exposure to currency movements between a SubFund’s Base Currency, and the currency in which the Hedged Share Class is denominated.

Such hedging strategies may not completely eliminate exposure to such currency movements. There can be no guarantee that hedging strategies will be successful. Mismatches may result between a Sub-Fund’s currency position and the Hedged Share Classes issued for that Sub-Fund.

The use of hedging strategies may substantially limit Hedged Share Class Shareholders from benefiting if the currency of the Hedged Share Class falls against the Sub-Fund’s Base Currency. The costs of hedging and all gains/losses from hedging transactions (and the transactions themselves) are allocated solely to the relevant Hedged Share Class.

Investors should also note that the hedging of Hedged Share Classes is distinct from any hedging strategies that the Investment Manager may implement at Sub-Fund level (the risks associated with which are described under Currency risks above).

15.8. Market risks

The investment policy for each Sub-Fund describes the FDIs which may be entered into on behalf of the SubFund. Pursuant to such policy, each Sub-Fund may also hold transferable securities and money market instruments as described in the relevant policy. In accordance with the terms of the FDI, the Sub-Fund should not ordinarily be exposed to the economic risk associated with such securities. However, in the event that the counterparty to a particular FDI defaults, the Sub-Fund may become exposed to the relevant securities’ economic performance. To this extent and to the extent that a Sub-Fund holds transferable securities and money market instruments directly in accordance with its investment policy, investors should be aware of the risks (described below) associated with the types of securities which may be held by the Sub-Fund.

15.9. The Index or Reference Assets

Where a Sub-Fund seeks to track the performance of an Index or Reference Asset to which it relates it may not always do so with perfect accuracy. Tracking error may arise as a result of a number of factors including the structure of the FDI, costs associated with entering into, renewing, adjusting and closing out such FDI, any other fees or costs, or any cash or other assets held by the Sub-Fund.

Some Sub-Funds may seek to generate a return in line with the performance of an Index or other Reference Asset with performance history that may be less than a year. In deciding whether to subscribe for Shares in such SubFund, prospective Shareholders have little or no performance record to evaluate the Index and Reference Asset returns prior to commencement of operations of the Sub-Fund. In any event there is no guarantee that the historic performance of any Index or Reference Asset will be tracked in the future.

The methodology to collect prices and to calculate the index value of some of the Indices or Reference Assets may be proprietary to the relevant index sponsor or other third parties.

The ability of a Sub-Fund which seeks to track the performance of the Index or Reference Asset to pursue its investment objective and policy is dependent upon the ongoing operation and availability of the Index or Reference Asset. Neither the Investment Manager nor the Fund is able to ensure the ongoing operation and availability of the relevant Index or Reference Asset. In the event that the Index or Reference Asset is disrupted or unavailable, the ability of the Sub-Fund to achieve the investment objective will become severely impaired or impossible. In the event that the Index or Reference Asset Index is permanently unavailable or discontinued, dealings in the SubFund may be suspended (pending closure of the Sub-Fund).

15.10. Interest Rates The values of fixed income securities held by a Sub-Fund, or to which a Sub-Fund’s performance is exposed, will generally vary inversely with changes in interest rates and such variation may affect Share prices accordingly.

15.11. Issuer Risk

In relation to any securities held by a Sub-Fund, or to which a Sub-Fund’s performance is exposed, the value of those securities may fall as well as rise, and there is no guarantee that historic performance will be repeated. A number of diverse and unrelated factors may cause the price of any securities to fall, including general economic and market conditions or political or social unrest. The value of any securities may not rise or fall in accordance with the general market, for example where the issuer of the securities in question is suffering or expected to suffer poor performance, or the industry or geographic location of the issuer is suffering or expected to suffer poor performance.

15.12. Real Estate Industry

A Sub-Fund may hold or be exposed to the performance of securities of companies principally engaged in the real estate industry. Such securities have specific risks associated with them. These risks include: the cyclical nature of real estate values, risks related to general and local economic conditions, overbuilding and increased competition, increases in property taxes and operating expenses, demographic trends and variations in rental income, changes in zoning laws, casualty or condemnation losses, environmental risks, regulatory limitations on rents, changes in neighbourhood values, related party risks, changes in the appeal of properties to tenants, increases in interest rates and other real estate capital market influences. Generally, increases in interest rates will increase the costs of obtaining financing, which could directly and indirectly decrease the value of a Sub-Fund.

15.13. Emerging Markets

A Sub-Fund may hold or be exposed to the performance of securities of issuers domiciled in emerging markets. In certain emerging countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments which could affect investment in those countries. There may be less publicly available information about certain financial instruments than some investors would find customary and entities in some countries may not be subject to accounting, auditing and financial reporting standards and requirements comparable to those to which certain investors may be accustomed. Certain financial markets, while generally growing in volume, have, for the most part, substantially less volume than more developed markets, and securities of many companies may be less liquid and their prices more volatile than securities of comparable companies in more sizeable markets. There are also varying levels of government supervision and regulation of exchanges, financial institutions and issuers in various countries. In addition, the manner in which foreign investors may invest in securities in certain countries, as well as limitations on such investments, may affect the investment operations of certain of the Sub-Funds.

Emerging country debt will be subject to high risk and will not be required to meet a minimum rating standard and may not be rated for creditworthiness by any internationally recognised credit rating organisation. The issuer or governmental authority that controls the repayment of an emerging country’s debt may not be able or willing to repay the principal and/or interest when due in accordance with the terms of such debt. As a result of the foregoing, a government obligor may default on its obligations. If such an event occurs, the Sub-Fund may have limited legal recourse against the issuer and/or guarantor. Remedies must, in some cases, be pursued in the courts of the defaulting party itself, and the ability of the holder of foreign government debt securities to obtain recourse may be subject to the political climate in the relevant country. In addition, no assurance can be given that the holders of commercial debt will not contest payments to the holders of other foreign government debt obligations in the event of default under their commercial bank loan agreements.

Settlement systems in emerging markets may be less well organised than in developed markets. Thus there may be a risk that settlement may be delayed and that cash or securities of the Sub-Funds may be in jeopardy because of failures of or defects in the systems. In particular, market practice may require that payment shall be made prior to receipt of the security which is being purchased, or that delivery of a security must be made before payment is received. In such cases, default by a broker or bank (the “Counterparty”) through whom the relevant transaction is effected might result in a loss being suffered by Sub-Funds investing in or exposed to the performance of emerging market securities. Where the Sub-Funds invest in markets where custodial and/or settlement systems are not fully developed, the assets of the Sub-Funds which are traded in such markets and which have been entrusted to sub-custodians, in the circumstances where the use of such sub-custodians is necessary, may be exposed to risk in circumstances whereby the Depositary will have no liability.

Morgan Stanley & Co. International plc may be appointed as sub-custodian.

The Fund will seek, where possible, to use Counterparties whose financial status is such that this risk is reduced. However, there can be no certainty that the Sub-Fund will be successful in eliminating this risk for the Sub-Funds, particularly as Counterparties operating in emerging markets frequently lack the substance or financial resources of those in developed countries.

There may also be a danger that, because of uncertainties in the operation of settlement systems in individual markets, competing claims may arise in respect of securities held by or to be transferred to the Sub-Funds.

Furthermore, compensation schemes may be non-existent or limited or inadequate to meet the Fund’s claims in any of these events.

Investments in the Russian Federation are subject to certain heightened risks with regard to the ownership and custody of securities. In this country this is evidenced by entries in the books of a company or its registrar (which is neither an agent nor responsible to the Depositary). No certificates representing ownership of such companies will be held by the Depositary or any of its local correspondents or in an effective central depository system. The ownership is not transferred to the buyer on trade date. Only upon the completion of the registration process is ownership passed on. Ownership is noted in the registrar’s records and the records of the correspondent and can be confirmed and evidenced by the possession of an ‘extract’. An extract demonstrates that a certain number of securities are recorded in the registrar’s or correspondent’s records as belonging to the owner at that point in time. As a result of this system and the lack of effective state regulation and enforcement, the Sub-Fund could lose its registration and ownership of such securities through fraud, negligence or even mere oversight. However, in recognition of such risks, the relevant correspondent to the Depositary has entered into agreements with company registrars and will only permit investment in those companies that have adequate registrar procedures in place. There is no single central securities depository in the Russian Federation established to manage the clearing, settlement and safekeeping of all securities. Furthermore, securities such as MinFin’s bonds are settled by a given and the de-facto central depository. Neither the Depositary nor the correspondent is responsible for the potential default of the depository.

Other risks could include, by way of example, controls on foreign investment and limitations on the repatriation of capital and the exchange of local currencies, the impact on the economy as a result of religious or ethnic unrest.

If a Sub-Fund invests more than 20% in emerging markets then an investment in the Sub-Fund should not constitute a substantial proportion of an investment portfolio and may not be appropriate for all investors.

15.14. Depositary Receipts

A Sub-Fund may hold or be exposed to depositary receipts (ADRs, GDRs and EDRs). These are instruments that represent shares in companies trading outside the markets in which the depositary receipts are traded. Accordingly whilst the depositary receipts are traded on recognised exchanges, there may be other risks associated with such instruments to consider- for example the shares underlying the instruments may be subject to political, inflationary, exchange rate or custody risks.

15.15. Non-Investment Grade Securities

Certain Sub-Funds may hold or be exposed to the performance of fixed income securities rated below investment grade. Such securities may have greater price volatility, greater risk of loss of principal and interest, and greater default and liquidity risks, than more highly rated securities. If a Sub-Fund invests more than 30% in these securities then an investment in the Sub-Fund should not constitute a substantial proportion of an investment portfolio and may not be appropriate for all investors.

15.16. Use of FDIs

The Investment Manager will enter into FDI transactions on behalf of each Sub-Fund as a key component of the investment objective and policy. While the prudent use of FDIs may be beneficial, FDIs also involve risks different from, and, in certain cases, greater than, the risks presented by more traditional investments. The following is a general discussion of important risk factors and issues concerning the use of FDIs that investors should understand before investing in a Sub-Fund.

15.16.1. Market Risk

This is a general risk that applies to all investments, including FDIs, meaning that the value of a particular FDI may go down as well as up in response to changes in market factors. A Sub-Fund may also use FDIs to short exposure to some investments. Should the value of such investments increase rather than fall, the use of FDIs for shorting

22

39777314.13

purposes will have a negative effect on the Sub-Fund’s value and in extreme market conditions may, theoretically, give rise to unlimited losses for the Sub-Fund. Should such extreme market conditions occur, investors could, in certain circumstances, therefore face minimal or no returns, or may even suffer a loss on their investment in that particular Sub-Fund. 15.16.2.

Liquidity Risk

Liquidity risk exists when a particular instrument is difficult to purchase or sell. If a FDI transaction is particularly large or if the relevant market is illiquid, it may not be possible to initiate a transaction or liquidate a position at an advantageous price (however, the Fund will only enter into OTC FDIs if it is allowed to liquidate such transactions at any time at fair value). 15.16.3.

Counterparty Risk

The Sub-Funds may enter into transactions in OTC markets, which will expose the Sub-Funds to the credit risk of their counterparties and their ability to satisfy the terms of such contracts. In the event of a bankruptcy or insolvency of a counterparty, the Sub-Funds could experience delays in liquidating the position and significant losses, including declines in the value of its investment during the period in which the Fund seeks to enforce its rights, inability to realise any gains on its investment during such period and fees and expenses incurred in enforcing its rights. There is also a possibility that these arrangements may be terminated due, for instance, to bankruptcy, supervening illegality or change in the tax or accounting laws relative to those at the time the agreement was originated. 15.16.4. Legal risk

There is a possibility that the agreements governing the derivative transactions may be terminated due, for instance, to supervening illegality or change in the tax or accounting laws relative to those at the time the agreement was originated. There is also a risk if such arrangements are not legally enforceable or if the derivative transactions are not documented correctly.

15.16.5. Other Risks

Other risks in using FDIs include the inability of FDIs to correlate perfectly with underlying securities, rates and indices. Many FDIs, in particular OTC FDIs, are complex and the valuation can only be provided by a limited number of market professionals who often are acting as counterparties to the transaction to be valued. FDIs do not always perfectly or even highly correlate to or track the value of the securities, rates or indices they are designed to track. Consequently, a Sub-Fund’s use of FDI techniques may not always be an effective means of following a Sub-Fund’s investment objective.

15.17. Swaps

Swaps are entered into in an attempt to obtain a particular return without the need to actually purchase the reference asset. Swaps can be individually negotiated and structured to include exposure to a variety of different types of investments or market factors. Depending on their structure, swaps may increase or decrease the SubFund’s exposure to long-term or short-term interest rates, currency values, commodities, indices, or other factors such as security prices, baskets of securities, or inflation rates. Depending on how they are used, swaps may increase or decrease the overall volatility of the Sub-Fund’s Net Asset Value. Swaps may embed an agreed fee or rate of return for the counterparty.

Most swaps entered into by a Sub-Fund would require the calculation of the obligations of the parties to the agreements on a “net basis”. Consequently, a Sub-Fund’s current obligations (or rights) under a swap generally will be equal only to the net amount to be paid or received under the agreement based on the relative values of the positions held by each party to the agreement (the “net amount”). The risk of loss with respect to swaps is limited to the net amount of payments that the Sub-Fund is contractually obligated to make. If the other party to a swap defaults, a Sub-Fund’s risk of loss consists of any margin or the net amount of payments that the Sub-Fund is contractually entitled to receive if uncollateralised.

15.18. Regulatory Oversight

The financial services industry generally, and investment managers in particular, has been subject to intense and increasing regulatory scrutiny. This scrutiny is expected to result in changes to the regulatory environment in which the Fund and any investment manager appointed to it operate and to impose administrative burdens on investment managers, including, without limitation, the requirement to interact with various governmental and regulatory authorities and to consider and implement new policies and procedures in response to regulatory changes. Such changes and burdens will divert such investment managers’ time, attention and resources from portfolio management activities.

15.19. Systems Risks

The Fund depends on the investment managers to develop and implement appropriate systems for the Fund’s activities. The Fund relies extensively on computer programs and systems to trade, clear and settle securities transactions, to evaluate certain securities based on real-time trading information, to monitor its portfolios and net capital and to generate risk management and other reports that are critical to the oversight of the Fund’s activities. In addition, certain of the Fund’s and its investment managers’ operations interface with or depend on systems operated by third parties, including Morgan Stanley & Co. International plc, market counterparties and their subcustodians and other service providers and the investment managers may not be in a position to verify the risks or reliability of such third-party systems. Those programs or systems may be subject to certain defects, failures or interruptions, including, without limitation, those caused by computer “worms”, viruses and power failures. Any such defect or failure could have a material adverse effect on the Fund and its Sub-Funds. For example, such failures could cause settlement of trades to fail, lead to inaccurate accounting, recording or processing of trades, and cause inaccurate reports, which may affect the investment managers’ ability to monitor their investment portfolios and their risks.

15.20. Operational Risk

The Fund depends on its investment managers to develop the appropriate systems and procedures to control operational risk. Operational risks arising from mistakes made in the confirmation and settlement of transactions, from transactions not being properly booked, evaluated or accounted for or other similar disruption in the Fund’s operations may cause the Fund and its Sub-Funds to suffer financial loss, the disruption of their business, liability to clients or third parties, regulatory intervention or reputational damage. The investment managers’ businesses are highly dependent on their ability to process, on a daily basis, transactions across numerous and diverse markets. Consequently, the Fund and its Sub-Funds depends heavily on the investment managers’ financial, accounting and other data processing systems. The ability of those systems to accommodate an increasing volume of transactions could also constrain a Sub-Fund’s ability to manage its portfolio.

15.21. Misconduct of Employees and of Third Party Service Providers

Misconduct by employees or by third party service providers could cause significant losses to the Fund. Employee misconduct may include binding the Fund and/or its Sub-Funds to transactions that exceed authorized limits or present unacceptable risks and unauthorized trading activities or concealing unsuccessful trading activities (which, in either case, may result in unknown and unmanaged risks or losses). Losses could also result from actions by third party service providers, including without limitation, failing to recognize trades and misappropriating assets. In addition, employees and third party service providers may improperly use or disclose confidential information, which could result in litigation or serious financial harm, including limiting the Fund’s and/or its Sub-Funds’ business prospects or future marketing activities. Although any investment managers appointed to the Fund or any of its Sub-Funds will adopt measures to prevent and detect employee misconduct and to select reliable third party service providers, such measures may not be effective in all cases.

15.22. Competition; Availability of Investments

Certain markets in which the Fund and its Sub-Funds may invest are extremely competitive for attractive investment opportunities and as a result there may be reduced expected investment returns. The Fund and its Sub-Funds will compete with a number of other participants who may have capital in excess of the funds available to the Fund and its Sub-Funds. There can be no assurance that an investment manager will be able to identify or successfully pursue attractive investment opportunities in such environments.

15.23. Litigation

With regard to certain of the Fund’s or its Sub-Funds’ investments, it is a possibility that an investment manager and/or a Sub-Fund may be plaintiffs or defendants in civil proceedings. The expense of prosecuting claims, for which there is no guarantee of success, and/or the expense of defending against claims by third parties and paying any amounts pursuant to settlements or judgments would generally be borne by the Sub-Fund and would reduce net assets or may, pursuant to applicable law, require investors to return to the Sub-Fund distributed capital and profits.

15.24. Directorships on Boards of Portfolio Companies

The Fund’s investment managers and/or their affiliates or designees may serve as directors of, or in a similar capacity with, portfolio companies, the securities of which are purchased or sold on or behalf of the Fund or its Sub-Funds. In the event that material non-public information is obtained with respect to such portfolio companies or a Sub-Fund becomes subject to trading restrictions pursuant to the internal trading policies of such portfolio companies or as a result of applicable law or regulations, a Sub-Fund may be prohibited for a period of time from purchasing or selling the securities of such portfolio companies, which prohibition may have an adverse effect on the Sub-Fund.

15.25. Proxy Contests and Unfriendly Transactions

A Sub-Fund may purchase securities of a company which is the subject of a proxy contest (or may initiate such a proxy contest) in the expectation that existing management can be convinced to or new management will be able to improve the company’s performance or effect a sale or liquidation of its assets so that the price of the company’s securities will increase. If such efforts fail, the market price of a company’s securities will typically fall, which may cause the Sub-Fund to suffer a loss.

In addition, where any such action is opposed by the subject company’s management, litigation can be expected to ensue. Such litigation involves substantial uncertainties as to outcome and may impose substantial cost and expense on the company and on the other participants in the litigation, including if applicable the Sub-Fund.

15.26. Debt Securities Generally

A Sub-Fund may have exposure to debt securities that are unrated, and whether or not rated, the debt investments may have speculative characteristics. The issuers of such instruments (including sovereign issuers) may face significant ongoing uncertainties and exposure to adverse conditions that may undermine the issuer’s ability to make timely payment of interest and principal. Such investments are regarded as predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal in accordance with the terms of the obligations and involve major risk exposure to adverse conditions. In addition, an economic recession could severely disrupt the market for most of these securities and may have an adverse impact on the value of such investments. It is also likely that any such economic downturn could adversely affect the ability of the issuers of such securities to repay principal and pay interest thereon and increase the incidence of default for such securities.

15.27. Convertible Securities

Convertible securities are bonds, debentures, notes, preferred stocks or other securities that may be converted into or exchanged for a specified amount of common stock or other securities of the same or a different issuer within a particular period of time at a specified price or formula. A convertible security entitles its holder to receive interest that is generally paid or accrued on debt or a dividend that is paid or accrued on preferred stock until the convertible security matures or is redeemed, converted or exchanged. Convertible securities have unique investment characteristics in that they generally (i) have higher yields than common stocks, but lower yields than comparable non-convertible securities; (ii) are less subject to fluctuation in value than the underlying common stock or other security due to their fixed-income characteristics and (iii) provide the potential for capital appreciation if the market price of the underlying common stock or other security increases.